With the amount of debt people are in and the way people spend too much and don’t save, it’s safe to say that financial literacy isn’t taught enough. Most schools don’t teach it, and most parents don’t teach it, but it’s extremely important.

Kids can start learning about money once they know how to count and sight-read numbers. Children learn at different paces, so there isn’t a set age when they should be counting and recognizing numbers. Since I’m a Reggio Emilia teacher, I believe in waiting for kids to show interest in counting and not forcing it. Most kids love to count and will show interest on their own. Let it happen naturally, and remember, don’t force your child to count if they’re not ready or not in the mood.

Books are a great way to introduce different concepts to your child. There are lots of cute children’s books like The Very Hungry Caterpillar and Five Little Monkeys Sitting in a Tree that introduces counting in a fun way. Many of my student toddlers also love First 100 Numbers because of the real pictures and bright colors.

While your child is starting to count and learn about numbers, there are things you need to consider before you start talking to them about money. These first three tips are more important than teaching your child what the value of a coin is and will affect their overall behaviors and attitudes about money for the rest of their lives.

1) Model Positive Attitudes About Money

I grew up with caretakers who always fought about money and were always worried about money. From the very beginning of my life, I associated money with stress and hated money because it just seemed to make people miserable and cause problems.

ALSO: The Best Apps to Teach Your Kids About Personal Finance

Your child is watching you all the time and modeling your behavior. One of the many things I learned about toddlers when I taught them was how much they understand and absorb. So, if you want your little one to have good money habits, you need to make sure that you have a positive attitude about money and good money habits first.

Don’t fight about money in front of your child, and don’t say things like “I don’t have enough money” or “I’m too broke.” If you want something but can’t buy it right now, say that you will need to save to get that thing you want but will get it.

If there is a bill that you need to pay but don’t have all the funds right now, instead of focusing on what you don’t have, focus on ways you can get that money and think of strategies so that you’re able to pay bills on time or even early in the future.

Save money and don’t spend more than you can afford. That sounds so simple but so many people can’t do that because they grew up seeing the opposite behavior growing up.

If you have a positive attitude about money, your child will have a positive attitude about money.

2) Teach Gratitude

Gratitude is severely underrated in our society. We’re so focused on goals and trying to get the next thing, that we forget to be present and be grateful for the things we have in our lives right now.

I have a journal where I write what I’m grateful for at least once a week. After I write down everything that I’m grateful for, I feel really good because it helps me be in the moment and appreciate what I have instead of focusing on what I don’t have.

You can teach your child to be grateful by telling them what you’re grateful for first and then asking them what they are grateful for. A good time to have this conversation is over a family meal or before bedtime. Make it a daily or at least weekly ritual so that your child learns this good habit and will be able to have that trait of gratitude during their life.

3) Volunteer and Give

There is a lot of truth to the saying, “The more your give, the more you receive.” Studies show that people who donate more end up making more money. Volunteering and donating to worthy causes also make you feel good and makes you feel abundant. It also puts things into perspective and helps you appreciate what you have.

This is a very valuable lesson for kids. When kids are still little, they are very much about themselves and need to be taught consideration for others. I recommend taking your child to volunteer at a homeless shelter or orphanage and to model giving money to people begging on the street. You can also volunteer at a soup kitchen to help feed low-income people.

Children need to see that not everyone is as fortunate as them but they can help those in need by giving and donating their time and money.

4) Play Games

So many counting games and early introduction to money games are perfect for different age levels. I make little lollipops out of paper for toddlers and stick them on popsicle sticks. Kids love gathering the lollipops and counting them. For kids who are past the age where they swallow little objects, games like “Hiho! Cherry-o” are great for teaching counting skills.

My toddler and kindergarten students loved role-playing. They really enjoyed pretending to be at the supermarket and ice cream parlor. You can buy a toy cash register, toy food, and a little basket or shopping bag for them to pretend to buy and sell food. I used cut-up construction paper to act as money.

5) Introduce Coins and Cash

Once your little one can sight-read numbers and can count, they’re ready to learn about coins and cash. Toddlers like to swallow things and put things in their mouths, so wait until they’re about 6 years old and are not going to eat the money!

They can start by washing coins with soap and water or soaking them in Coca-Cola. Coca-Cola has so many strong chemicals that it can clean coins! As the kids are washing the coins or dropping them in Coke, you can tell them how much each coin is worth. Once they have the coins’ worth memorized, you can tell them the names of each coin.

If your child is old enough not to wrinkle or rip cash, you can introduce paper money by having them look at the bills and teaching them the amount, as well as how to tell how much a bill is. You can play a game where you’re buying or selling toys to have your child practice giving and receiving the right amount of money to buy the toy.

6) Show Your Child How You Use Money

When you’re out shopping, use cash and have your child give the money to the sales clerk, so they can start understanding how money is used. If you’re using a credit card, explain to your child that the card is connected to a bank that has your money. Explain how the card is being swiped and that you have a receipt to show that you paid.

ALSO: You Should Encourage Your Teen to Travel After High School

With little kids, you need to narrate everything so that they understand what is happening and why it’s happening. In Japan, the salesclerks narrate everything they’re doing as they’re ringing you up, so you need to be a Japanese salesclerk whenever you’re with your child and using money in the real world.

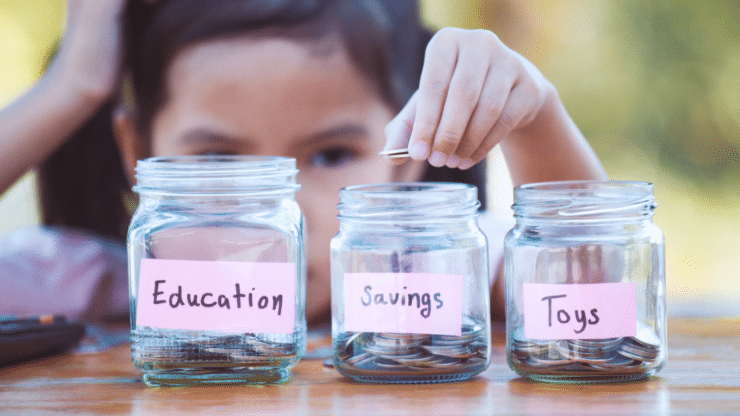

7) Teach Your Child How to Save

There are so many adorable banks that light up and play songs when you put money in. Even a simple piggy bank sans bells and whistles is fun for kids. Toddlers especially enjoy putting objects in slots, so as long as your child doesn’t put coins in their mouth, they can have a piggy bank and start learning how to save money.

8) Give an Allowance

Once your child is old enough to differentiate between different coins and bills and can give you the right amount of money when you’re pretending to sell them something, they’re ready to have an allowance every week.

If there is a special treat they like, you can give them enough money and ask them to save it until it’s time to go to the ice cream parlor or convenience store so they can buy that treat themselves.

If your child wants a particular toy, they can save up for it with their allowance. Explain to them how many weeks it will take for them to get that toy based on how much they’re getting for the allowance each week. If they want to spend their money on something else, ask them if they still want the toy, so they know they need to save that money if they still want it.

Add comment